Will Your Savings Run Out in Retirement?

Monday, May 9, 2011

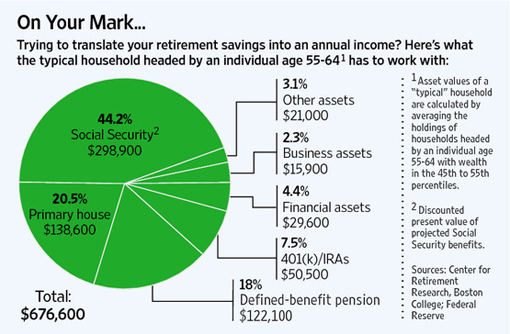

It's among the most important and difficult questions would-be retirees face: How much of my nest egg can I afford to spend each year?

The financial-services industry has some answers for you.

Some of the industry's biggest players are introducing free or low-cost services that will help you convert your savings into a reliable stream of lifelong income. The products are aimed primarily at the millions of baby boomers who, though hesitant to hire a financial adviser, are unsure of how to spend their nest eggs without running a significant risk of going broke.

[More from WSJ.com: Retirement: Women at Risk]

"People aren't adept at figuring out how to translate a 401(k) balance into an annual income," says Carol Waddell, vice president at T. Rowe Price Retirement Plan Services Inc., a unit of T. Rowe Price Group Inc. of Baltimore. "Many retirees spend their money far too quickly."

Powered by sophisticated software, the services, which feature hand-holding from financial advisers, estimate how much a retiree can afford to spend annually. They typically provide advice on how to invest retirement savings to maximize the odds of making a nest egg last. In many cases, the sponsors can manage the money for you, issuing regular monthly paychecks.

Some of the services are more accessible than others. Fidelity Investment's new Income Strategy Evaluator is open to anyone who walks into a branch, calls a toll-free number or logs on to the company's website.

In contrast, Charles Schwab Corp.'s Retirement Planning Consultation is available only to clients. Other services are reserved for participants in 401(k) and other defined-contribution plans. These include offerings from T. Rowe Price and several 401(k) advisers, including Financial Engines Inc. of Palo Alto, Calif., GuidedChoice.com Inc. of La Jolla, Calif., and Chicago-based Morningstar Inc.'s investment management unit.

[More from WSJ.com: Retiring in 10 Years? Uh oh.]

What should you look for? Some services offer more comprehensive guidance than others. Those from Fidelity and Schwab, for instance, can take into account every source of retirement income available to an investor and his or her spouse--including Social Security, pensions and assets held in 401(k), brokerage and individual retirement accounts.

In contrast, T. Rowe Price's Retirement Income Manager and Financial Engines' Income+ offer recommendations only on drawing down assets held in 401(k) accounts. "Our target customer is a person for whom a 401(k) account represents a large share of retirement wealth," says Christopher Jones, chief investment officer at Financial Engines.

The firms' investment recommendations can differ widely, too. When structuring retirement portfolios, T. Rowe Price sticks mainly to mixes of stocks, bonds, and cash, or cash equivalents.

[More from WSJ.com: Should You Roll Over Your 401(k)?]

Financial Engines' Income+ program moves about 80% of an average retiree's 401(k) balance into bonds, says Mr. Jones. (The program sets aside a small portion to give the investor the option to buy an immediate annuity at any time up to age 85, thus securing an income for life.) To provide potential for growth, the company typically invests 20% in stocks, an allocation it gradually shifts into bonds as the account owner ages.

Fidelity takes yet another approach. Its Income Strategy Evaluator aims to cover such essential expenses as housing and food with highly predictable income sources such as Social Security and defined-benefit pension checks. Fidelity frequently recommends those with shortfalls plug the gap with annuities and mutual funds, says John Sweeney, executive vice president. But because annuities aren't appropriate for everyone--and some people don't want to purchase them immediately upon retiring--Fidelity also offers recommendations without annuities.

|

___

Popular Stories on Yahoo!: